tax abatement nyc meaning

For one there are many different types of abatements given to buildings for different reasons. The J-51 tax abatement is an exclusive tax benefit given to some building owners.

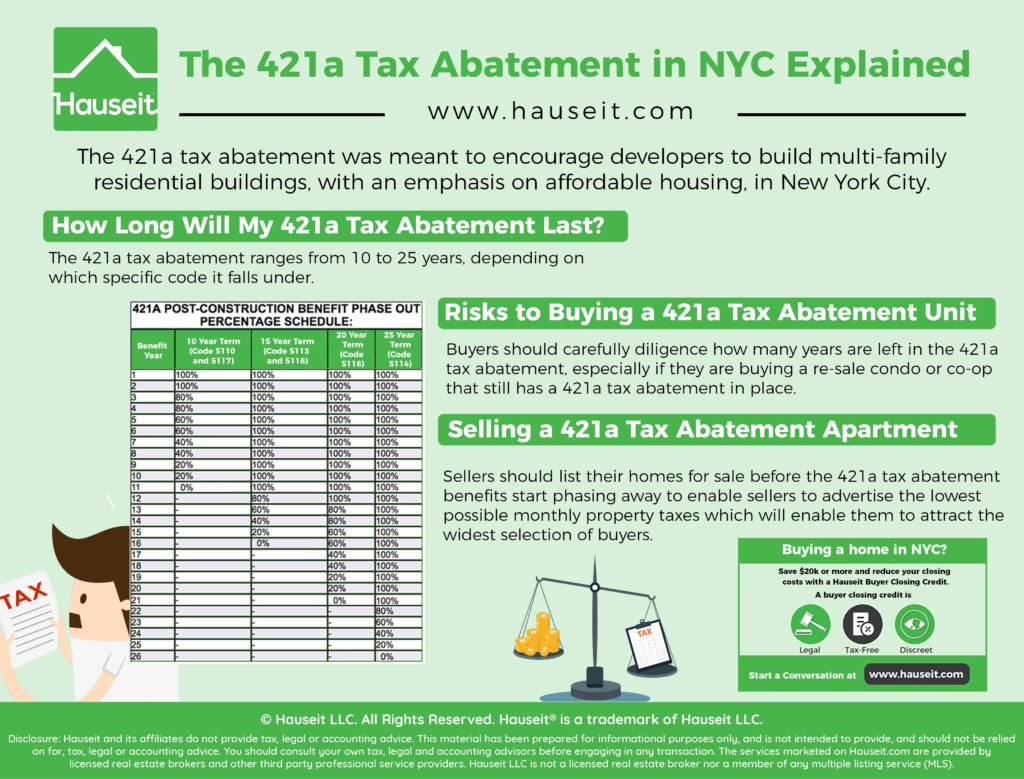

The 421a Tax Abatement In Nyc Explained Hauseit

During the time period thousands of New Yorkers were moving upstate or to the suburbs and City officials feared a decline in residential development.

. Building management boards of directors or other official representatives must apply for the co-op or condo abatement on behalf of the eligible building units. Perhaps the most well-known is the 421a abatement which recently expired but gave developers and. A few points about abatements.

Tax abatement nyc meaning. Low- to middle-income residents are usually the target demographic for these programs. Although towns and cities.

A co-op tax abatement assessment is authorized by the Board of Managers also known as the co-op board. The J-51 tax abatement is an exclusive tax benefit given to some building owners. A J-51 abatement is a form of tax exemption that freezes the assessed value of your structure at the level before you started.

However properties that currently receive a 421-a 421-b or 421-g tax abatement are not eligible to receive the abatement. What Is a Tax Abatement. The School Tax Relief STAR exemption provides owners of houses co-ops or condos in NYC that have an annual household income of 250000 or less with property tax.

Owners of cooperative units and condominiums who meet the requirements for the Cooperative and Condominium Property Tax Abatement can have their property taxes reduced. Put simply a tax abatement is exactly what it sounds like. In most jurisdictions there are multiple.

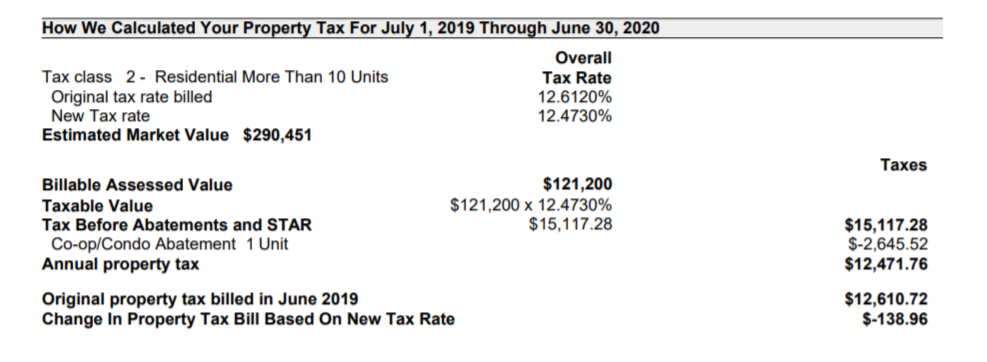

More than half or 56 of all the citys multifamily residential units created in the past eight years involved 421-a according to Housing Preservation and Development data analyzed by the Real Estate Board of New York. In short a tax abatement is when the government grants a reduction or exemption from taxes for a specific period in order to stimulate real estate or industrial development. Abatements reduce your taxes after theyve been calculated by applying dollar credits to the amount of taxes owed.

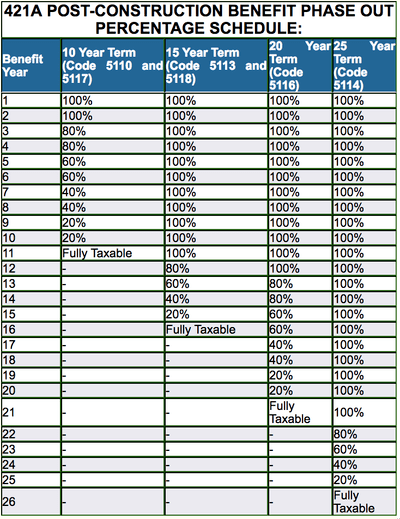

There are multiple variations of the 421a tax abatement ranging from terms of 10 to 25 years. Also available is a list of all NYC Tax Incentive Programs. Homebuyers can understand the true meaning of the abatement by knowing when it will expire.

The 421-a tax abatement was created in 1971 to encourage the development of underutilized or unused land by significantly reducing property taxes on newly developed land for a set period of time. More details can also be found in HCR Fact Sheet 41. Industrial Commercial Abatement Program ICAP The 2022-2023 renewal period has ended.

The tax abatement was meant to encourage developers to build multi-family residential buildings with an emphasis on affordable housing in New York City. You may owe zero taxes for 10 years then 25 of normal taxes in year 11 50 in year 12 etc. Of course in practice its a little more complicated than that.

First of all the J-51 abatement is rare compared to the more famous 421a program. A break on a building or apartments property taxes. New York City Property Tax Exemptions.

To be eligible for this benefit you must have renovated your structure or plan to convert an industrial or commercial structure into a residential building. Abatements can last anywhere from just a few months to multiple years at a time. For more information click here.

The New York City Department of Finance has adopted a rule amendment of the Real Property Tax Abatement for Cooperative or Condominium Dwelling Units. What Is The 421a Tax Abatement NYC. Make sure you understand the phasing-in schedule.

Second the J-51 program is a combination of both a tax exemption and a tax abatement. To be eligible industrial and commercial buildings must be built modernized expanded or otherwise physically improved. This program provides abatements for property taxes for periods of up to 25 years.

To determine the beginning and end dates for tax benefits given to a building for either of these two programs visit the NYC Department of Finance J-51 Exemption and Abatement and 421-a Exemption webpages. The J-51 tax abatement is unique for many reasons. A tax abatement is a property tax incentive government entities issue that will reduce or eliminate taxes on real estate in a specific area.

The 421a tax abatement got its name from the section of New York Real Property Tax Law establishing it in 1971. A tax abatement is a property tax incentive government entities issue that will reduce or eliminate taxes on real estate in a specific area. If youre shopping around for a co-op or condo in NYC youre bound to encounter some real estate jargon in listings.

The exemption also applies to buildings that add new residential units. The debit is the amount of assessment which is based proportionally on the number of shares assigned to. ICAP replaced the Industrial Commercial Exemption Program ICIP which ended in.

One of those perplexing terms is 421a tax abatement. If a co-op chooses to levy an assessment shareholders will receive both a credit and a debit on their monthly maintenance statement. Similar to a 421a the J-51 abatement is to promote the development of multiple-dwelling affordable housing however a J-51.

A rapid phase-in can be a financial shock. Everybody still with. In essence its a tax exemption program given to building developers that typically lowers the property taxes for residential units for some time.

The second-highest tax break an abatement for coops and condos cost 655 million last year. Co-op and condo unit owners may be eligible for a property tax abatement. The reduction percentage is between 175 and 281 if the owners meet certain requirements to apply for the abatement.

The short answer is likely going to sting so lets rip this bandage off early. Make sure you have a realistic sense of your actual tax burden once the abatement expires. The 421a tax abatement is a tax bill granted to property developers and focuses on affordable housing in densely populated areas of New York.

How Much Is The Coop Condo Tax Abatement In Nyc

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo

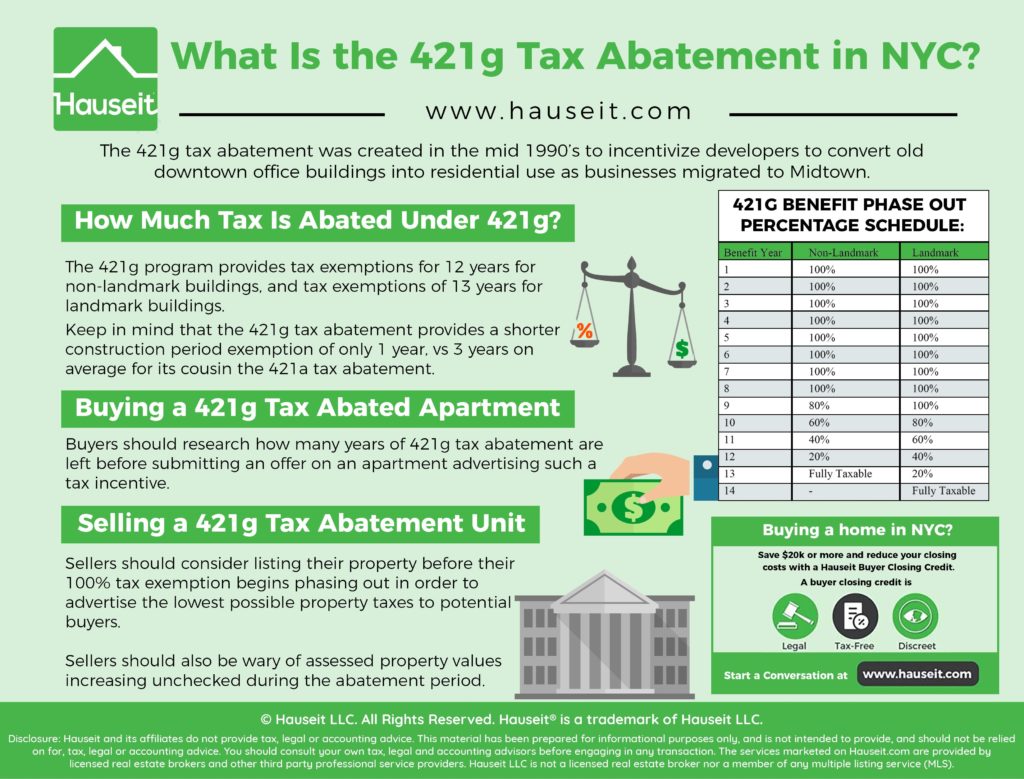

What Is The 421g Tax Abatement In Nyc Hauseit Tax Lower Manhattan Meant To Be

The Real Reasons Your Home Is Not Selling Buying A Condo Reasons Building Management

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo

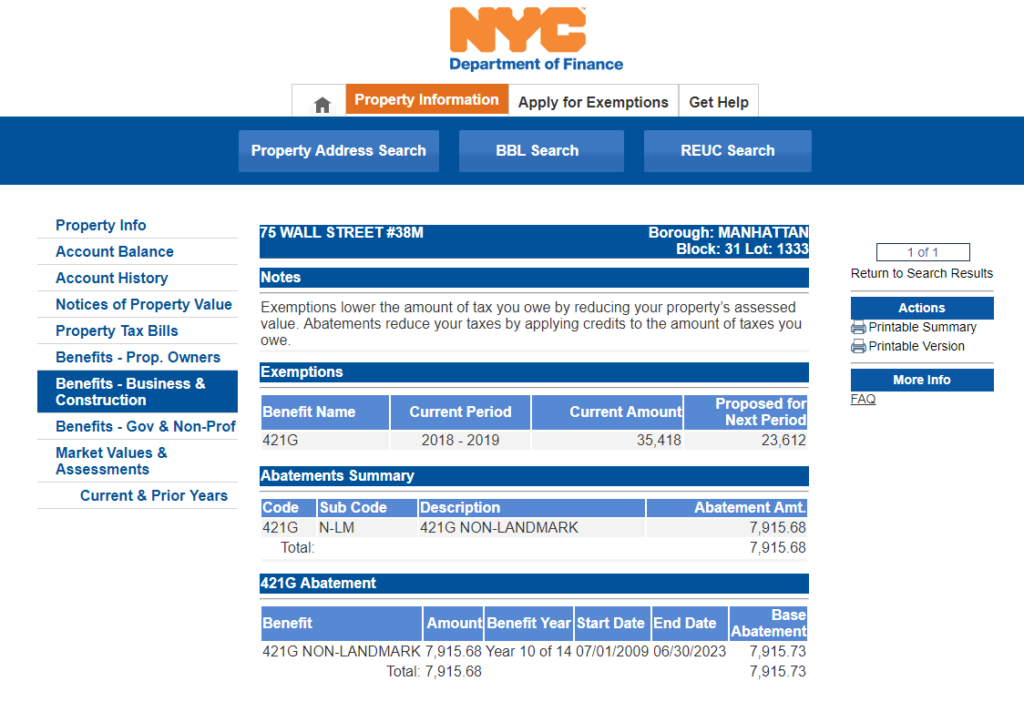

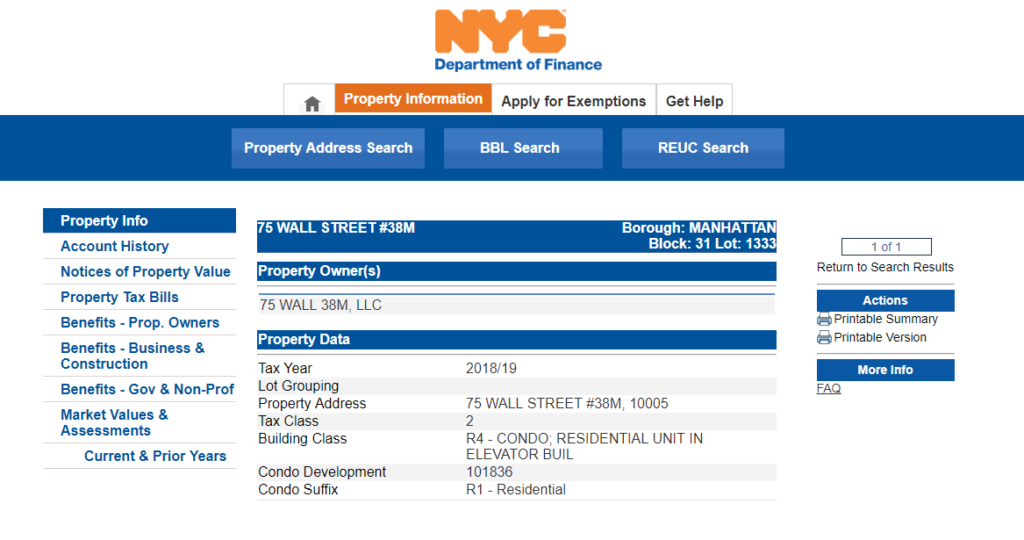

What Is The 421g Tax Abatement In Nyc Hauseit

What Is The 421g Tax Abatement In Nyc Hauseit

What Is The 421g Tax Abatement In Nyc Hauseit

Nyc Real Estate Taxes 421a Tax Abatements And Manhattan Property Tax

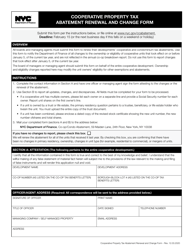

New York City Cooperative Property Tax Abatement Renewal And Change Form Download Fillable Pdf Templateroller

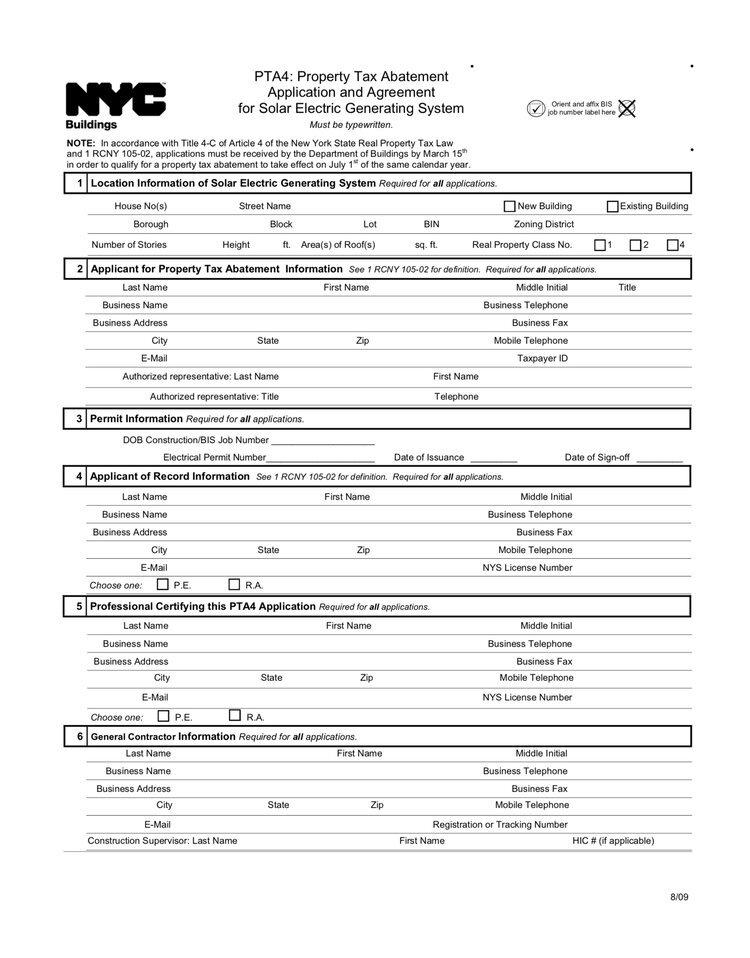

Nyc Solar Property Tax Abatement Pta4 Explained 2022

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo

What Is A 421a Tax Abatement In Nyc Streeteasy

The 421a Tax Abatement In Nyc Explained Hauseit

Solar Property Tax Exemptions Explained Energysage

How To Calculate The Unabated Property Taxes On A Nyc Condo With A 421a Tax Abatement Youtube